Generative AI in Fintech: A Complete Guide

Key Takeaways:

Generative AI improves efficiency by automating repetitive back-office tasks and reporting. It allows teams to focus on higher-value work rather than manual operations.

It enhances customer experience with AI-powered chatbots and personalized services, while strengthening compliance through real-time monitoring and fraud detection.

Gen-AI also speeds up decision-making by providing insights on lending, investments, and risk management. It scales innovation by enabling rapid testing of new financial products and solutions.

A decade ago, banks competed on speed. Today, speed is the baseline. What really sets fintechs apart is intelligence: answering complex customer queries in seconds, detecting fraud before it happens and personalizing every interaction. Generative AI in fintech made all this possible.

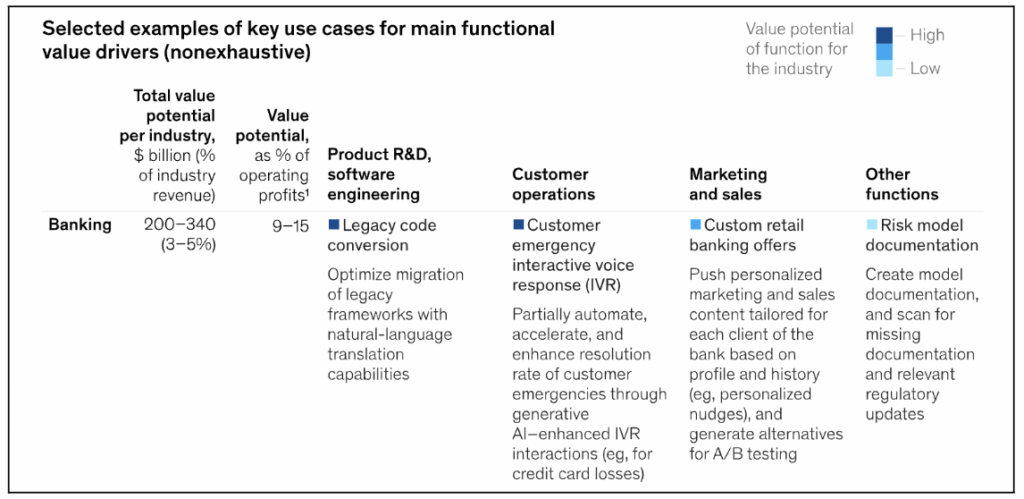

McKinsey estimates that AI could unlock $200–$340 billion annually for banking. But the challenge is knowing where to start.

When fintech founders reach out to Tech Exactly, the conversations usually fall into two buckets:

- About a third already know what they want. Say, plugging OpenAI APIs into their platform or building an AI-powered loan chatbot.

- The rest start with big ambitions like, “We want to use AI in our app,” but are not sure where to begin.

And that is perfectly normal. Not every team needs to have the answers on day one. Our job is to take those ambitions and shape them into a practical solution.

The opportunity is huge, but the real question is:

- How can AI for fintech help financial institutions use it safely?

- Where does fintech generative AI create the most impact?

- What are the generative AI use cases in fintech?

This article will guide you in exploring the answers!

How Generative AI Is Transforming FinTech

After discussing what generative AI means and why it matters in our earlier blog, it is time to see how it is changing financial services.

A recent PwC study report found that 90% of financial institutions use Gen AI for innovation. That number is only growing as banks look for ways to keep up with customer expectations.

Case Study: Morgan Stanley Adopts GPT-4 for Advisor Support

Overview

Morgan Stanley has introduced two powerful generative-AI tools: 1. Morgan Stanley Assistant and 2. Debrief. Both were built on GPT-4 to assist financial advisors in handling client interactions and researching more efficiently.

What It Does?

- Morgan Stanley Assistant helps advisors quickly retrieve insights from over 100,000 internal reports and documents in real time, effectively acting like the most informed colleague at your side.

- Debrief aids in generating, reviewing, and summarizing meeting notes with clients, streamlining record-keeping and follow-ups.

Why It Matters?

Unlike consumer-facing chatbots, these tools are designed for internal use, enhancing productivity while maintaining human oversight. They reduce manual workload, support more informed decisions and mitigate risks like AI hallucination since humans review the AI’s outputs before action. This approach illustrates how generative AI is evolving beyond automation to become a trusted assistant in high-stakes finance.

The way we manage money has changed forever. From mobile banking to instant payments, digital is now the default. But behind the scenes, generative AI in fintech is the driving force.

This is more like a new layer of financial intelligence. It does more than automate tasks. It learns patterns, predicts outcomes and creates new solutions.

▶️Read: How Finance Leaders Are Upgrading Smarter in 2025

At Tech Exactly, we witness this transformation first-hand. One of our fintech clients approached us with a common challenge: borrowers struggled to get quick and clear answers about their loan terms. Whether repayment dates, interest clauses, or outstanding amounts. Traditional support teams often spend hours manually searching through contracts, causing delays and driving up costs.

To address this, we, as a fintech app development company, are developing a GenAI-powered loan servicing agent designed to make borrower interactions effortless.

Here’s how it works:

- Natural Language Understanding (NLP): The voice agent listens to borrower queries.

- Contract Parsing: An automated parser identifies the relevant contract section.

- Generative AI (core layer): GenAI transforms the raw clause or data into a simple, conversational explanation that borrowers can easily grasp.

- Voice Delivery: With ElevenLabs, the response is delivered back to the borrower in real time.

In this solution, GenAI does more than just retrieve information. It translates dense legal language into plain, accurate explanations. Reducing confusion, easing the support burden, and giving borrowers the answers they need instantly.

Key Advantages of Generative AI for Fintech

What makes generative AI in fintech worth the investment? Is it about saving costs, time, or does it go further?

I approached our Business Analyst, who is often the first point of contact for clients. He mentions that many queries from clients we receive initially assume Gen-AI is only about improving productivity and reducing workforce dependency like cutting costs and turnaround time. And yes, that is a big part of the story.

Here are the advantages of AI in banking, explained:

- Revenue & margin

One of the biggest advantages of AI in banking is its ability to spot the right opportunity at the right time. When you understand customer behaviour in detail, you are not just reacting, but you can anticipate too.

Take this example: A customer’s transaction history shows frequent travel bookings, higher international spending and a recent increase in credit card usage. Instead of sending a generic loan offer, AI can flag this as a sign that the customer may soon need extra liquidity. Perhaps for an extended trip or even a property purchase abroad.

At that exact moment, the bank can suggest a tailored travel loan or a premium credit card upgrade. Because the offer feels relevant and timely, the chances of acceptance go up significantly. This means more cross-selling opportunities and, ultimately, stronger profit margins without extra customer acquisition costs.

- Security & risk:

Fraud often erodes customer trust, which is a lot harder to rebuild. Fraud is expensive and damages trust. Unlike traditional systems that rely on static rules, AI continuously learns from transaction patterns and can flag unusual activity in real time.

91% of U.S. banks now use AI for fraud detection, and one credit union network saved about $35 million in fraud over just 18 months after deploying AI-driven tools.Read how we transformed loan lifecycle management for a FinTech company by reducing loan processing and application load time.

- Operational efficiency:

Let’s talk about operational efficiency: how generative AI is reshaping back-office work and delivering real results for fintech and banking firms.

Traditionally, it requires teams to sift through endless spreadsheets, compare records and chase down mismatches.

Generative AI applications in fintech automate those heavy, repetitive steps. Staff who once spent entire days buried in document prep are freed up to focus on analysis, strategy, and customer engagement.

Tech Exactly saw this first-hand while developing the mobile app for the World Fintech Festival. Organizers needed a way to manage schedules, updates and reporting without constant manual effort. Our solution reduced time spent on manual updates, allowing the team to focus on real-time event updates.

Apart from generative ai use cases in banking, let’s look at some stats:

→Mastercard: AI fraud tool improves detection by 300% and reduces false positives.

→DBS Bank: Another good gen ai use cases in banking. A chatbot “KAI” resolves 80% of customer queries, cutting response times to seconds.

→Morgan Stanley: GenAI tools summarize 100,000+ research reports for faster advisor insights.

→Citigroup: AI analyzed 1,000+ pages of new capital regulations to speed compliance.

- Decision speed & quality:

In financial services, timing can make or break a deal. Markets shift by the second and decisions that once took days now need to be made in hours or even minutes. That is where AI gives banks and fintech institutions a clear edge.

Instead of analysts manually combing through reports, spreadsheets and market feeds, AI systems can analyze millions of data points at once.

Case Study: JPMorgan Chase’s COIN

JPMorgan Chase faced a slow and error-prone process in reviewing commercial loan agreements. To streamline this, they developed COIN (Contract Intelligence), an AI-driven system powered by natural language processing and machine learning.

How it works:

COIN rapidly analyzes legal loan documents, extracting key terms, identifying risks and flagging inconsistencies automatically.

The result? A process that used to take 360,000 labor hours per year, reviewing around 12,000 agreements, is now completed in a fraction of the time.

This shift means faster loan processing, significantly reduced risk of human error, and massive time savings that allow staff to focus on higher-value tasks.

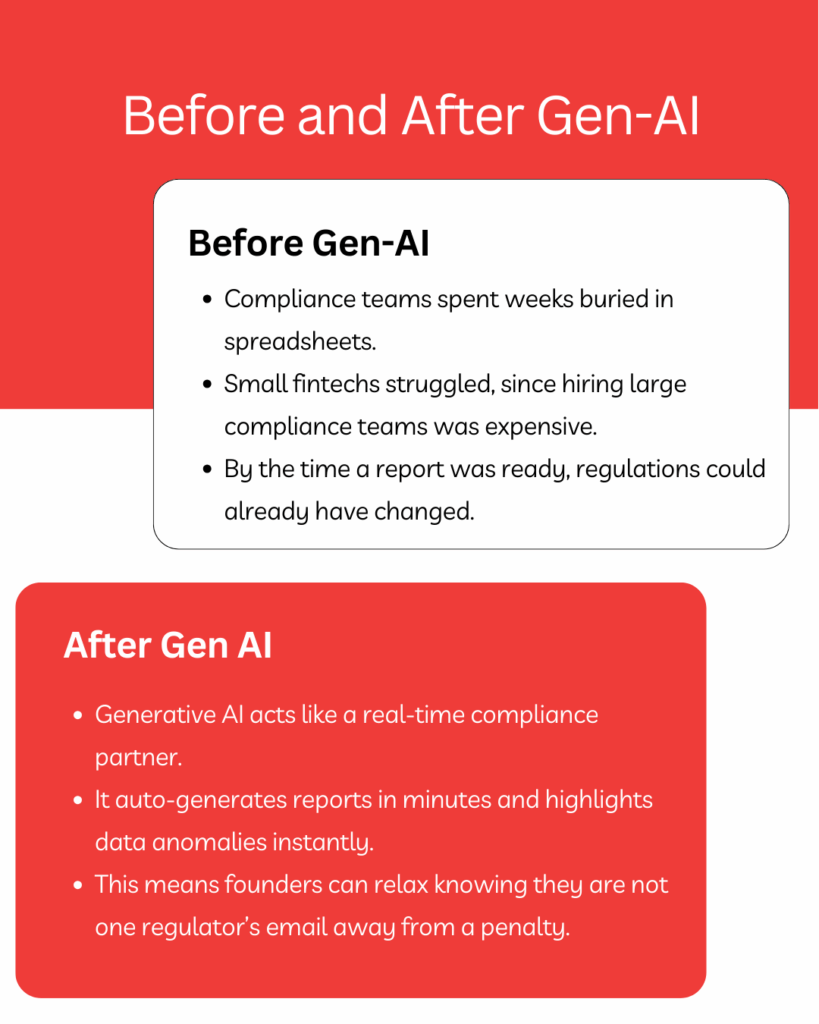

- Compliance & reporting:

Regulations in finance are becoming tighter every year, and missing even the smallest detail can cost firms millions in fines and reputational damage. Traditionally, compliance teams spend endless hours reconciling transactions, preparing reports and checking for inconsistencies.

Gen-AI is changing this by automating the entire process. It pulls data from multiple systems, generates audit-ready reports in the right regulatory formats, and flags errors before they escalate. The result is faster, more accurate compliance with less manual effort.

▶️Read how fintech Gen-AI creates accurate reports, flags errors and ensures regulators get the right data on time. - Scalable innovation:

Scalable innovation has always been a challenge in fintech. Traditionally, testing a new product, say, a lending feature, might take months. Teams would manually collect historical data, run multiple risk models and conduct limited simulations before moving to a prototype. By the time the product reached the market, customer needs or competitor offerings might have already shifted.

With generative AI in fintech, the process looks very different. Instead of relying on manual modelling, AI can simulate thousands of risk scenarios in days.

For example, without AI, a bank might spend six months validating a new credit product; with generative AI, it can simulate repayment risks across different customer segments in a fraction of the time and launch confidently, staying ahead of competitors while reducing exposure to costly errors.

More than just abstract benefits of ai in banking, it improves revenue, cuts costs, reduces risk and protects long-term growth. You will realize the advantages of AI in banking are financial as well as strategic.

Use Cases of Generative AI in FinTech

Seven out of ten financial firms are already experimenting with generative AI in fintech. The question for businesses here is not “if” but “how.” For lean fintech startups, the biggest value lies in saving time and money: automating reconciliations, reducing fraud losses and enabling faster credit approvals.

We know generative AI is a great resource, but where is it actually making a difference?

As published in CNBC, Satya Nadella, CEO of Microsoft, recently emphasized that AI is already reshaping how people work.

Let us look at some generative AI use cases in fintech that financial institutions are already using.

Chatbots

Generative AI chatbots are like the self-checkout counter of banking. Fast, always available and efficient. Just like shoppers no longer want to stand in long lines for a cashier, banking customers no longer want to sit on hold or navigate endless phone menus.

With AI-powered chatbots, customers can get answers instantly, whether it is about a blocked card, loan eligibility, or account transactions.

A real-world case study is Bank of America’s Erica, its AI-driven virtual assistant. According to a 2023 report, Erica has now handled over 1.5 billion interactions, with clients currently engaging 56 million times per month. What is more striking is that over 60% of these interactions are now personalized and proactive insights rather than just basic queries. Clients use Erica every month to:

- Track expenses like food services and gym memberships – 3.6 million times

- Get breakdown of spending patterns – 2.1 million times

- Receive alerts of merchant refunds – 863,000 times

- Check upcoming bills – 332,000 times

- Review their FICO score – 267,000 times

For fintech founders, the takeaway is simple: chatbots are more than cost-saving tools. They are digital relationship managers, delivering hyper-personalized insights at scale and keeping customers engaged around the clock.

Portfolio management

Managing investments has always been complex. Markets shift quickly and even experienced investors struggle to track everything in real time. This is where AI-based portfolio management helps. Instead of manually scanning reports or relying on generic advice, fintech apps now use generative AI to analyze huge volumes of market data instantly, while also adapting to each user’s risk profile, financial goals and past behaviour.

The result? Investors get personalized, data-backed strategies without the overwhelm. The impact is already visible in the market.

According to Allied Market Research, the global robo-advisory market (AI-driven investment platforms) is projected to reach $129.5 billion by 2032, growing at a CAGR of 32.5% from 2023 to 2032.

A good example here is Betterment, one of the largest AI-powered robo-advisors in the US.Compliance management

Compliance management has always been a moving target in finance. Regulations change constantly and a single oversight can result in fines running into millions. Traditionally, compliance teams spent weeks compiling reports, cross-checking transactions and manually scanning for errors. Not only is this costly, but it also slows down operations.

This is where generative AI changes the equation. Instead of teams juggling spreadsheets and compliance manuals, AI can:

- Auto-generate accurate compliance reports in minutes.

- Spot anomalies in data that humans may overlook.

- Track evolving regulations across multiple jurisdictions and flag relevant updates in real time.

Financial analysis and forecasting

What if I told you that some financial institutions using generative AI have already seen an increase in forecast accuracy by 25%? For a fintech founder, that could be the difference between scaling confidently or running into unexpected cash flow gaps.

Generative AI takes the guesswork out of forecasting by crunching massive datasets in real time. It does not just look at historical numbers, it spots early signals in customer behaviour, market conditions and risk factors well before they are obvious to the human eye.

Imagine knowing a borrower segment’s default risk months earlier, or catching a liquidity shortfall before it derails your next funding round. With AI, financial strategy shifts from being reactive to predictive and that edge is priceless when you are competing in fintech.

Financial advisor

What if you could offer every user and at any time, the kind of tailored investment advice that traditionally requires a full-time human advisor? That’s precisely what generative AI enables in fintech.

AI-powered financial advisors analyze individual goals, risk appetites and real-time market signals to deliver personalized guidance on saving, investing, and paying down debt. Unlike brick-and-mortar services, these digital advisors scale seamlessly, cut costs and stay available 24/7.

Case Study: Conquest’s AI-Powered Advisory Platform

Toronto-based fintech Conquest offers an AI-driven financial planning platform that supports around 60,000 advisors across 1,000 institutions, including Morgan Stanley, RBC and JPMorgan. Their proprietary AI tools analyze client data from income and savings to financial goals and deliver personalized planning recommendations that streamline advisor workflows. This scalable system helps advisors speed up plan creation (over 1.5 million financial plans generated so far), making financial advice more efficient and widely accessible. Funded by Goldman Sachs and Citi, Conquest underscores how generative AI is radically transforming the reach and cost-effectiveness of advisory services.

AI-based fraud detection

Every fintech founder knows the sinking feeling: fraud is often caught after the damage is done. In 2024 alone, fraud losses climbed to $12.5 billion, according to Plaid’s CEO. Traditional rule-based systems cannot keep up with evolving attack methods, leaving both companies and customers vulnerable.

Generative AI shifts this narrative by:

- Spotting anomalies in real time before they turn into costly fraud cases.

- Adapting to new fraud patterns without waiting for manual rule updates.

- Reducing false positives, so legitimate customers are not blocked unnecessarily.

📌 Examples :

- PayPal uses AI to analyze billions of transactions daily, flagging suspicious activity instantly.

- JPMorgan Chase has deployed AI models that scan customer behaviour to block fraudulent wire transfers before they are processed.

- American Express uses machine learning to analyze every card swipe in real time, generating fraud decisions in milliseconds. Over $1.2 trillion in annual transactions.

Loan score management

Millions of people get shut out from credit because they just don’t have a traditional financial history to show.

That’s where Generative AI in fintech market steps in. By tapping into alternative data such as spending habits, rent payments, digital transactions, and more. Instead of relying only on outdated credit files, AI builds a complete picture of creditworthiness: faster, fairer and inclusive.

- Evaluates behaviors, not just credit history.

- Approves credit more equitably, including underserved borrowers.

- Reduces default risk by factoring in real-time financial behaviors.

Take Upstart as a standout example: by analyzing over 1,000 data points per applicant, this AI-powered platform approved 43% more borrowers while maintaining 53% fewer defaults, compared to traditional scoring methods

▶️Read how we helped a Fintech company build a compliant loan lifecycle management app, decreasing loan processing time and enhancing user experience.

Automation of back-office processes

Think of your back office as the engine room of a ship. It is not glamorous, but it keeps everything running.

Generative AI acts like a turbocharged engine upgrade. Automating loan application reviews, reconciling payments and updating records in real time.

The result?- Cuts turnaround times from days to hours.

- Reduces manual errors by automating reconciliations and data entry.

- Improves productivity by letting teams focus on client-first activities.

Financial report generation

Regulators demand precision and report generation is time-consuming. Generative AI automatically compiles financial data, ensures accuracy and generates reports that are regulator-ready. This not only shortens reporting cycles but also reduces compliance risks.

Legacy software maintenance

Many financial institutions still run on legacy systems that are difficult to modernize. Generative AI helps refactor old code, identify weak spots and enable integration with modern fintech solutions.

The Limits of Generative AI in Finance and Banking

While the potential of generative AI in fintech is undeniable, it is equally important to understand its limitations. Financial institutions operate in highly regulated, data-sensitive environments where not everything can be automated or left to algorithms. A few critical challenges stand out:

- Data quality: AI is only as good as the data it learns from. Inconsistent, incomplete or outdated data can lead to inaccurate outputs. In finance, even small inaccuracies may result in costly compliance breaches or flawed customer insights.

- Privacy and security: Handling sensitive financial data means strict adherence to data protection laws such as GDPR and PCI DSS. Generative AI systems must be designed with strong encryption, access controls, and compliance checks. Otherwise, they risk exposing institutions to data leaks or regulatory penalties.

- Bias: AI models can inherit or amplify biases present in training data. In lending, for instance, biased datasets may unintentionally disadvantage certain groups of customers, raising ethical concerns and potential legal liabilities.

- Numerical accuracy: Unlike traditional rule-based systems, generative AI is probabilistic. It can generate plausible but numerically incorrect outputs. This is especially problematic in areas like risk assessment, portfolio modelling or automated financial reporting where precision is non-negotiable.

Conclusion

Generative AI is no longer a “nice-to-have” in fintech. It is reshaping how institutions deliver customer service, manage compliance and drive efficiency. Yet, its success depends on tackling challenges such as data quality, security and accuracy.

The real question is not whether to adopt GenAI, but how. Choosing the right generative AI development company can make the difference between a proof of concept and a scalable, secure solution.

At Tech Exactly, we not only build GenAI solutions for clients but also use them internally. This hands-on use means we understand both the strengths and the limits of generative ai in fintech and how to apply it responsibly.

So, if you already have an idea in mind or want our help shaping one, share it with us at info@techexactly.com.

FAQ

Generative AI automates complex financial tasks, enhances customer interactions, detects fraud, supports forecasting, and helps institutions make faster, smarter, and more personalized decisions.

Safe usage of Generative AI in fintech requires clean, high-quality data, strong security and encryption. Adherence to regulations like GDPR, and continuous checks to minimize bias or errors.

Common applications include AI-powered chatbots, fraud detection, loan scoring, portfolio management, automated reporting, financial forecasting, and modernizing legacy systems.

Generative AI in fintech analyzes large datasets in real time, detects early signals in customer behaviour and market trends, and improves forecast accuracy by up to 25%, reducing risks and enabling predictive decision-making.

Challenges include data quality, privacy concerns, bias in models, and occasional numerical inaccuracies. Human oversight is still essential for critical tasks like compliance, risk assessment, and lending decisions.

Manas Das, Mobile App Architect at Tech Exactly, has over 9 years of experience leading teams in iOS, Android, and cross-platform development. He specialises in scalable app architecture and GenAI-driven mobile innovation.