A Definitive Guide to Build a Health Insurance App

Look no further than the past year to realise the importance of mobile services in healthcare industries. Had it not been for the digitization of healthcare data, healthcare industries, too, would have crashed like several others. Health insurance giants and start-ups around the world are focusing on healthcare apps for their services, with companies like Oscar adapting this approach as early as 2012. The similarity between companies like Humana, UnitedHealth and Oscar Health is that they leveraged digitisation of healthcare data by developing healthcare insurance apps for remote access and management. Such an approach enabled them to continue providing seamless customer services when the need came calling the most- during the Covid-19 pandemic.

Market Overview

Studying the market is a key element in making decisions about product development, distribution and market. We have analysed a few report and summarised the key findings here:

- According to Grand View Research, the global health insurance market was valued at US$2.4 trillion in 2019 and is estimated to expand at a CAGR of 6.7% through 2020 to 2027.

- High cost of healthcare services, increase in prevalence of chronic diseases, increasing disposable income, practice of providing health insurance as benefits to employees by employers, government’s focus on expanding health coverage to low-income groups (example Affordable Care Act in the US) are some of the factors contributing to the growing demand.

- Covid-19 has created a positive impact in the industry. There has been a rise of 50.0% in the queries related to health policies due to the global pandemic.

- The life insurance segment is expected to continue dominating the market for healthcare insurance. It accounted for 53.3% of the total revenue in 2019.

- The term insurance segment is anticipated to grow at a lucrative rate of 7.4% over the forecast period. This is largely due to its lost cost and high coverage. It mainly provides safety against the increasing cost of medical treatments.

- Private providers segment is projected to register the fastest CAGR of 7.0% during 2020-2027. This is because private providers offer prompt referral to a consultant, advanced treatment option, and quick & flexible treatment time in private hospitals to its subscribers.

- North America, primarily the United States accounted for the largest revenue share of 41.0% in 2019. The total market value of the US Health & Medical Insurance industry reached US$1 trillion in 2020.

- Asia Pacific is expected to grow at the highest CAGR of 8.9% in the health and medical insurance market during 2020-2027. Low and middle-class economy groups in populous countries like India & China, that are currently not insured, are expected to provide an opportunity to the health insurance market in this region.

These numbers indicate that the market for healthcare insurance products is aggressively growing but is also competitive in nature. Hence, policy providers are using advanced digital tools, artificial intelligence, and advanced analytics to meet evolving customer expectations by offering them innovative plans and reducing the cost of healthcare.

Mobile applications for health insurance enable easy communication, better management and processing of policies & related data, ultimately providing a seamless experience to both customers and officials.

Read further to look at the important aspects of developing a health insurance app and how we, as a healthcare app development company, can help you achieve that goal.

- Why should you consider investing in health insurance mobile apps?

- Essential Features to Build the Best Health Insurance App

- 6 Broad Stages of Health Insurance App Development

- Cost to Develop a Mobile App for Health Insurance

Why should you consider investing in health insurance mobile apps?

Let’s take a look at a few points that highlight the significance of health insurance mobile apps in overcoming existing challenges and providing seamless operations in the future.

1. Immediate Access to Health Insurance Officials

Insurance has always been synonymous with long wait times and long queues of patients to get in touch with an insurance official. Health insurance mobile apps allow better and quicker communication between patients and officials that ultimately saves time & contributes to better customer satisfaction.

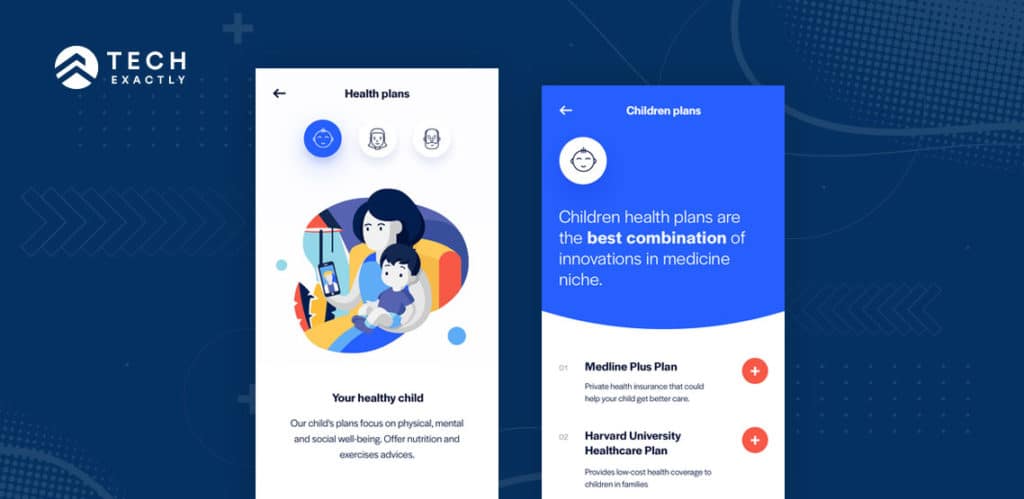

2. Help Patients Choose the Right Plan

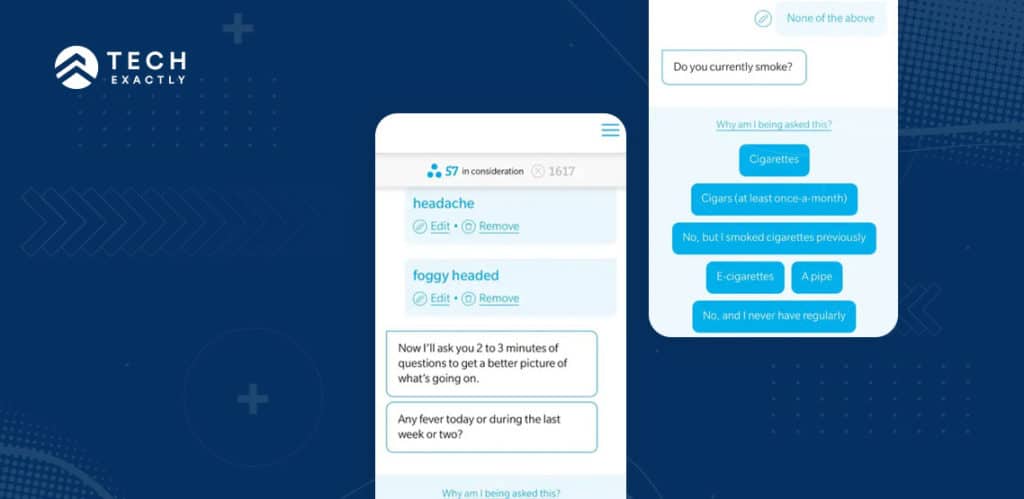

Choosing among so many healthcare plans can get overwhelming for anybody. With an app, you can help users select the most suitable plan by analyzing their information. Maybe, create a small questionnaire to define customer needs and then suggest the perfect plan (example – Oscar). Or, have a comparison table for users to compare medical coverage, advantages, features, pricing of various plans and then choose the best suited one (example – Aetna).

3. Improve Operational Efficiency & Scale up your Business

A fundamental aspect of health insurance is management of records. Using traditional methods, insurance companies deal with huge amounts of paper-based data on a regular basis which is tedious and tiresome. Proper management of such huge data is key to the development and stability of this vast, growing industry. With mobile apps, you can ease out your operations by recording all information digitally.

Because a mobile solution helps you provide excellent customer service, it is likely to attract new clients, thereby making your company more profitable. Moreover, with an app, you can better communicate your insurance plans to your prospective customers (for example – explicit screens for different types of medical coverage, their benefits, premiums, etc) or upgraded plans to your existing customers, increasing the probability of converting them into actual or higher sales.

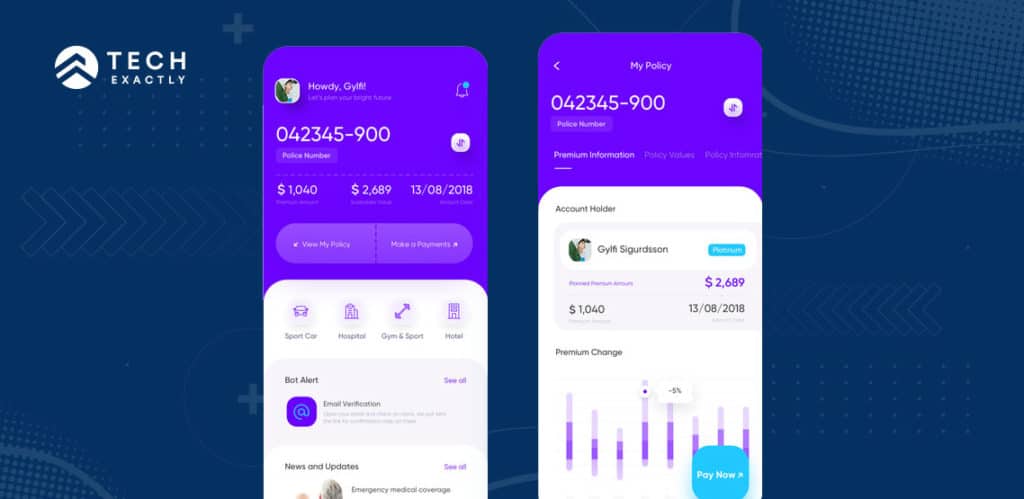

4. Easy Payments

Your users do not have to stand in queues anymore to pay their insurance premiums. A secured payment gateway in your medical insurance app allows users to make payment right from the app. It also enables them to make changes to their existing plans with only a click.

5. Better Brand Promotion and Reputation

Mobile apps have proven to be effective as a marketing tool by pushing a brand through push notifications, news, promotions and offers.

Mobile apps allow you to generate feedback and user trends to better manage and improve shortcomings or errors in services. This improves service and hence, the image of a brand.

Essential Features to Build the Best Health Insurance App

You need to make sure you have the best app out in the market that covers every aspect of your business. Here are some of the essential features required to build the best health insurance app.

1. Health Insurance Plans Listing

For customers, it’s always difficult to comprehend so much information about so many insurance options available at their disposal. Hence, it’s very important to think through the simplest way of presenting information about all your active insurance plans in the app. Some of these are:

- Have separate screens for each plan providing detailed information about characteristics, features, coverage, benefits, pricing, etc.

- Present information in tabular format allowing users to compare plans and then select the best suited.

- Have a FAQs section for users to get answers to their queries immediately.

- You may also consider to get a short questionnaire filled by interested parties, to first know their requirements and then suggest the best available policy.

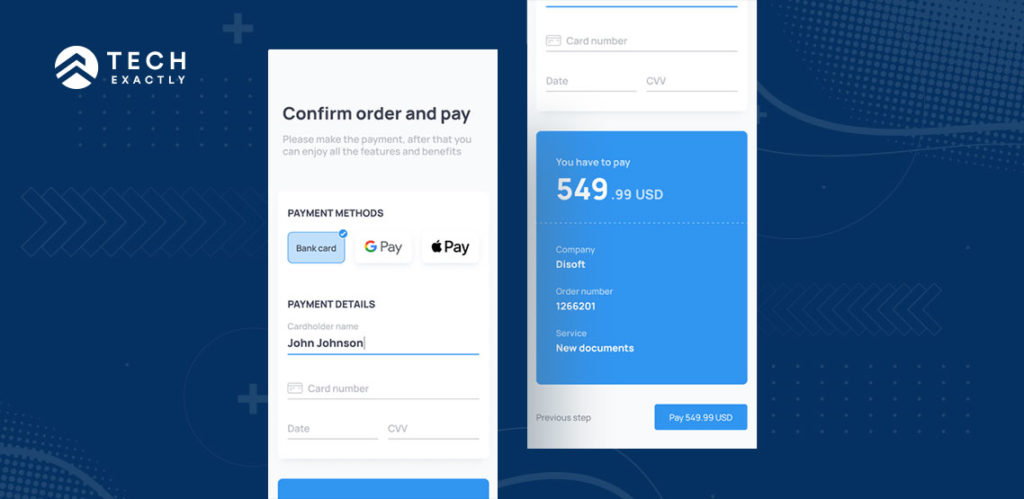

2. Purchase or Renew Plans

Using traditional methods, applying for a health insurance policy is very time-consuming. So, once a user has chosen a policy, allow them to buy/ renew/ upgrade their plans from the app itself. For this, you must definitely implement a secured payment gateway in the app.

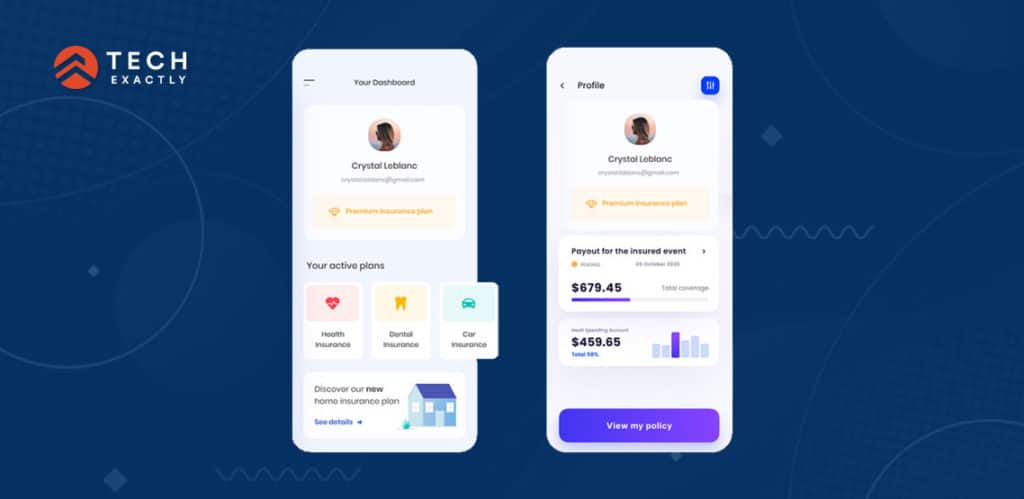

3. User Profile & Dashboard

Create a simple user profile in the app by collecting basic information like name, age, height, weight, etc. Your clients should also be able to check their policy details, nominee details and access their insurance ID cards at any moment under their profile section.

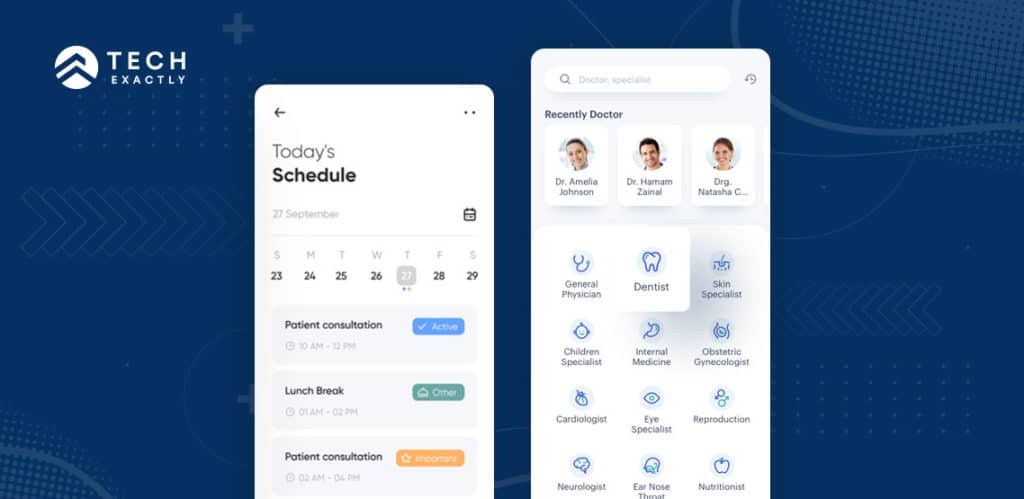

4. Search for in-network Doctors, Hospitals

For patients, it’s always tough to find doctors/hospitals/clinics who cooperate with their health insurance company. Hence, your app must enable your users to view the complete database of in-network doctors (name, experience, qualification, specialisation, etc) so that a he/she can avail the best medicare.

For better customer experience, include several search & filtering options. For example, search by name, location, specialisation or filter by experience, fees, etc.

Further, you may enable geolocation for users to find the nearest doctor, hospital or clinic using the app, in case of an emergency.

5. Search for Drugs & Alternatives

Health insurance companies and pharmacies tie-up frequently to make medicines easily available to their patients. If you also tie-up with pharmacies, allow users to find nearby stores and get prescribed medications delivered at their doorstep. With this feature, users will also be able to get information about prescribed medicines, know alternatives of such medicines and also compare drug prices between listed stores to find the best price.

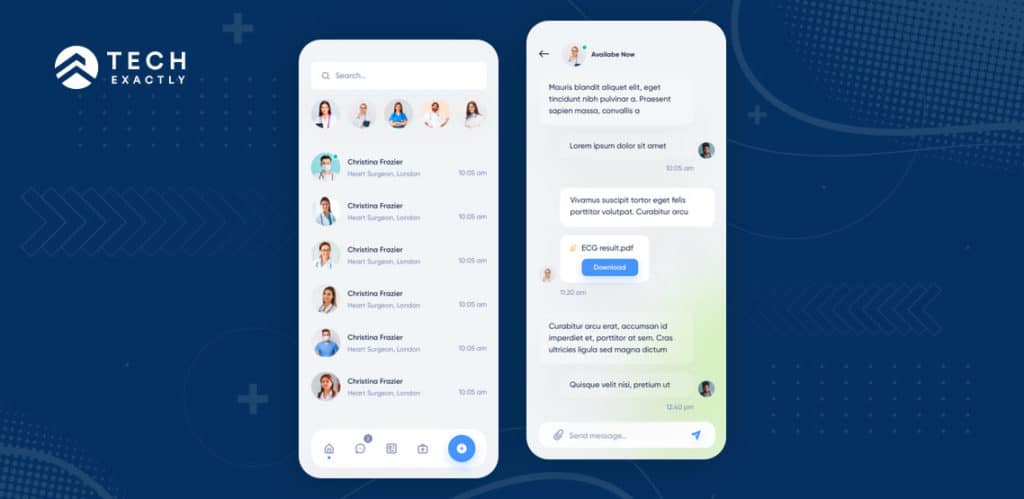

6. Doctor-Patient Communication

Most users these days look for a hassle-free experience to book doctor appointments. Let users know available dates and slots for appointments for all doctors and make a booking right there. Ease of access to doctors will always attract more customers.

Your app must also support the virtual set up where the patient is not able to physically visit a doctor. In this case, doctors can be consulted via video conferencing, in-app calling or real-time chat. Irrespective of the medium of communication, there’s a need for end-to-end encryption and adherence with regulations.

7. Record & Share Health Documents

A health app should be a reservoir for all health records. Hence, have a database to store all patient electronic medical records like ECG, x-ray report, blood test report, diet & nutrition chart, prescription, policy papers at one place. This adds to the convenience to make relevant information available to the concerned parties anytime.

For ease, you may allow users to share such records with doctors. Again, encryption here is of utmost importance to safeguard sensitive data from man-in-the-middle (MitM) attacks.

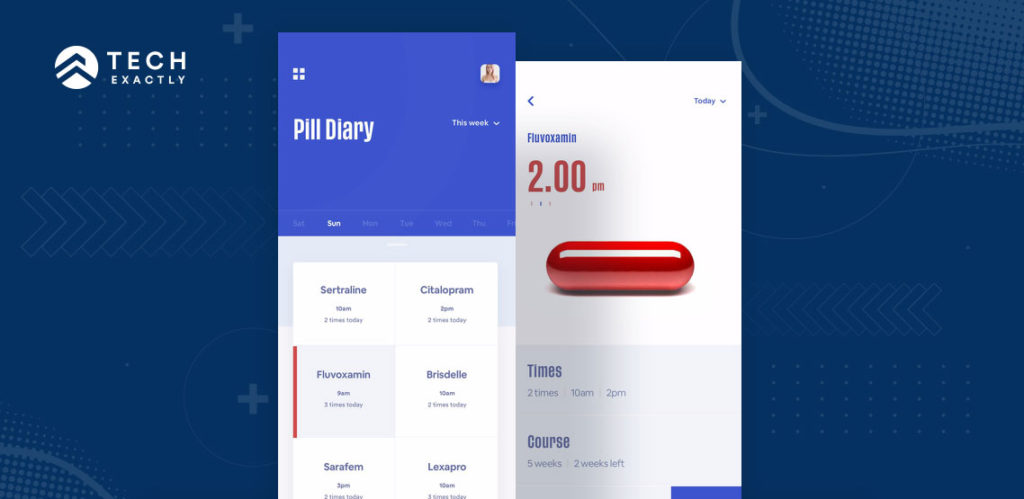

8. Symptom checker

To get a competitive edge, enable your application to conduct a preliminary diagnosis of patients before they visit a doctor. Understand patient’s symptoms via chatbots or questionnaire and leverage the power of AI to direct them to the right specialist. Example – Buoy Health.

9. Notifications & Reminders

Implement push notifications to remind users about upcoming doctor appointments, due premium payments, insurance renewals, or about an update on their insurance claims, etc.

10. Payment

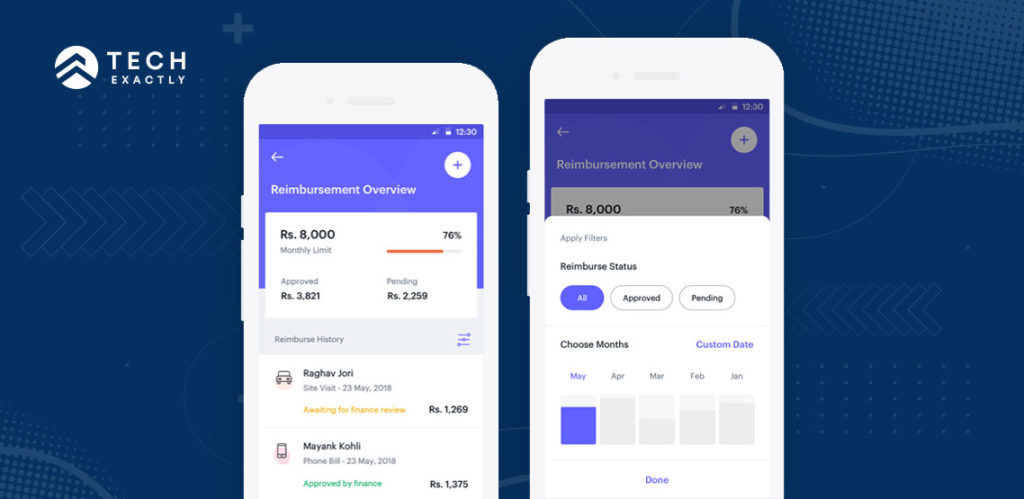

For convenience, a patient must have multiple & secure payment options at its disposal so that he/she can pay for doctors, medicines or premiums directly from the insurance app. In addition, users must be able to view payment history and past invoices for future reference.

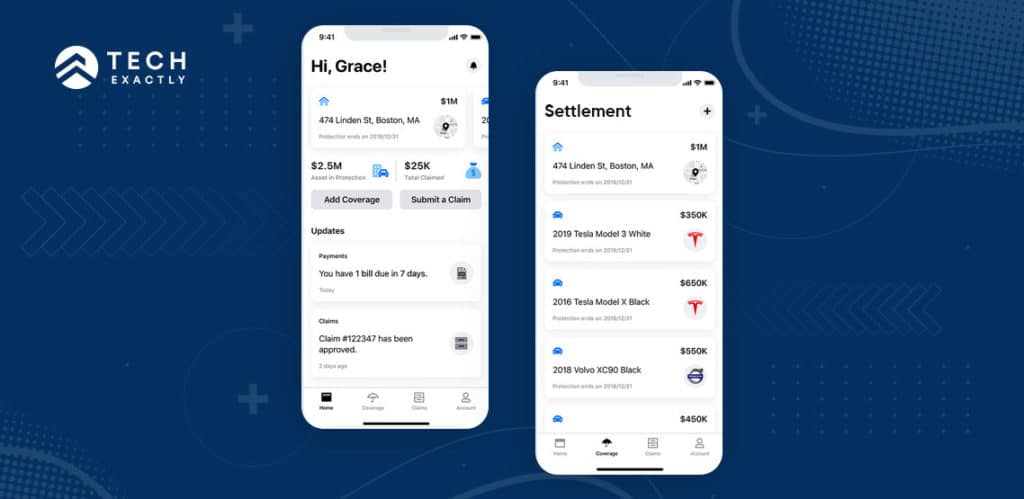

11. Claim Application & Settlement

Go a step ahead and allow your users to apply for & settle insurance claims via your app. This will prompt users to attach medical bills and receipts or upload photographs of accident sites taken through mobile or notify the health insurance company from the accident site without having to contact the customer service team. And because the insurance policy details of the applicant is already handy in the app, it helps the insured to quickly apply for claims and helps the insurer to process claims faster, thereby reducing the overall turnaround time.

12. Latest Claim updates

After applying for a claim, it’s important for the applicant to have a regular update on it. Based on which stage the application is, you can use tags like – Review in Progress, Waiting for Additional Information, Pending Approval, Completed, etc. Providing users with the ability to view real time claim status eliminates the need for them to call their managers each time and get a status update, hence providing better experience to both the parties. Make sure to allow users to view their claim history for future reference.

13. Support Team

Health insurance companies mobile apps should have Frequently Asked Questions (FAQ) sections to help users through the basic questions regarding the app and the services. For further queries & immediate assistance, a hassle-free communication with associates of the support team or chatbot must be made available 24X7.

6 Broad Stages of Health Insurance App Development

The key stages in health insurance app development are:

1. Define target audience and identify expectations

You have to define the target audience for your product. A health insurance mobile app can be either a patient app, an app for healthcare providers or an app to provide solutions for internal processes of an insurance company. However, the modern day app is a stable combination of all 3.

Your product should be smart to offer innovative solutions and features to meet your target’s needs and requirements. Expectations can be identified by generating customer feedback and market surveys.

2. Analyze your Competitors

Players like Oscar, Aetna and Cigna became frontrunners of the insurance industry by adapting unique and progressive marketing techniques. They invested in interactive platforms and apps to better connect with the customers to identify changing needs and delivering on the existing ones.

It is fundamental that your mobile app isn’t categorised under the basic apps with banal layouts. Your app should reflect the quality of your product and services, and must be interactive, stable, simple and different than that of your competitor.

3. Designing

Medical insurance apps have these large volumes of data associated with the products, services and patients. Such data has to be presented in the simplest yet most attractive manner. Moreover, your app should be intuitive and easy to use which will provide users with the necessary functions at their fingertips. Simple UI with interactive features is the key to a successful app.

Remember, if your product is too complex, it will hinder user experience and ultimately result in its failure.

4. Build a prototype (optional)

Most successful mobile apps have adopted the procedure of releasing a prototype or beta version of the apps that they design. These prototypes are released for use over a limited period of time, and help in generating crucial feedback. The feedback is then used to remove bugs and stabilize the platform before the final release. This helps to save you cost & time and moreover, build a better liked product for your users.

5. Follow Healthcare Data Protection Regulations

Data security is one of the most important elements for any healthcare app. If you’re creating apps for medical insurance plans then you must adhere to data protection guidelines based on which region your app is being released in.

- Apps operating in the US must be HIPAA (Health Insurance Portability and Accountability Act) and HITECH (Health Information Technology for Economic and Clinical Health) compliant.

Refer article – How to build a HIPAA Complaint App for a detailed study on HIPAA.

- For EU countries you have to be GDPR compliant

- In the UK, the Data Protection Act sets the data-storing standards.

- In Canada you need to abide by the PIPEDA (Personal Information Protection and Electronics Document Act).

- If your app has a payment gateway, you have to abide by the PCI-DSS which is a global information security standard to secure online payments.

6. Thorough Testing and Maintenance

To ensure that the app is stable and load is low, constant testing and maintenance is a must. The testing team takes care of bugs, instabilities and unusual or excess data load to prevent the apps from crashing and provide a smooth experience.

Cost to Develop a Mobile App for Health Insurance

The cost to develop a mobile app for health insurance is dependent on several factors. Some of these are:

- Number of platforms you want to release your app in.

- Required number of health insurance app features in your application

- App design – the more complex your design is (say, animations), the more you pay.

- Tech Stack – Native or cross-platform, Laravel, Python, Twilio, Push.io, Nexmo, AWS, Google, Azure, HBase, Cassandra, Postgres and MailChimp Integration, etc.

- Whether using advanced technologies such as AI and Machine Learning.

- Expected timeline to build your app

- The location of medical insurance app developers also matters. For example – generally speaking, developers in the USA charge more than Indian developers.

- Size of the development team

To give you a ballpark figure, the minimum budget for a healthcare mobile app development should be around $60,000 for a single platform, which can go up to $500,000 or even more.

Just to sum it up

Customer’s demand for better experience and remote access doesn’t seem out of place when you consider a technology driven life on one hand and a pandemic on the other. Mobile apps are effective tools to manage volumes of data and to give you the edge in the market that will help you stay ahead of your competition.

You must be wondering whether it’s a good idea to build a medical insurance app when so many players are already in the market? The answer is a definite yes. Developing a health insurance app is a great startup idea. Why? With rising healthcare costs, increasing awareness about insurance benefits and governments initiatives to expand health coverage, the demand for insurance is only on the rise. Moreover, players that already exist in the market like Oscar either do not operate throughout the US, or do not cover all kinds of health insurance policies, or have certain gaps in their services. This gives entrepreneurs ample opportunity to step in the market, solve existing problems and make health insurance more simpler and accessible.

As you can see, medical insurance mobile app development is pretty challenging. Tech Exactly is a specialised healthcare app development company that offers you innovative, customised and fully-functional solutions you need to boost your healthcare business. Our team of knowledgeable & experienced developers, designers and security experts use latest & smart technology stacks and will happily toil to make you an feature-rich yet affordable health insurance application.